The Services of the Estate Manager

Basic services

The noise associated with day-to-day tasks can be overwhelming and confusing, especially during this difficult time for family members who are not accustomed to managing everything in the household. Effective financial planning and trusted estate management can alleviate some of this burden, ensuring that legacy preservation is prioritized amidst the chaos.

Legacy Database

The Estate Manager works together with the family to identify and organize the various household accounts. The complexity and sheer number of accounts can vary greatly among families but typically include accounts such as credit cards, utilities, home/auto/health insurance, banking, and investments. All of these accounts are clearly outlined in the “Legacy Database” and the database provides the roadmap for future needs.

Expanded services

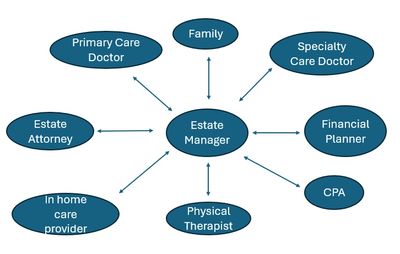

The Estate Manager can also play a critical role in the organization and communication among all the various team members. The Estate Manager provides continuity for the family and is a central point of contact for the family. Conversations and dialogue that previously may have been limited become open and transparent in order to ensure that the legacy of the loved one is preserved.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.